We drive inflows into sustainable funds

Our Wealth-Tech solution provides effective end-investor engagement on three dimensions:

Risk + Return + Responsibility

We drive inflows into sustainable funds

Our Wealth-Tech solution provides effective end-investor engagement on three dimensions:

Risk + Return + Responsibility

Global assets under management in ESG-oriented funds by 2026.

of consumers want their money to do good, as well as deliver a return.

investors say they think that many investments that claim to be sustainable actually aren’t.

Supporters

We have received support, investments, and developed strategic partnerships.

Together, we drive forward our joint vision to make sustainable investment the new normal.

A product suite to empower wealth and investment advisors

With our U Impact software-as-a-service (SaaS) product suite, we are here to increase the capital flow towards sustainability.

Our software is provided as an easy-to-integrate white-label solution.

- U Connect

- U Select

- U Insight

U Connect

Seamless connection and integration of your existing ESG and regulatory disclosure data to achieve automated portfolio look-through and sustainability analysis.

Sustainable fund look-through

Automated portfolio look-through for increased trust and transparency.

ESG data integration

Flexible integration to multiple existing and future data sources.

Leverage what you already have

Utilise your existing regulatory datasets for revenue generation.

U Select

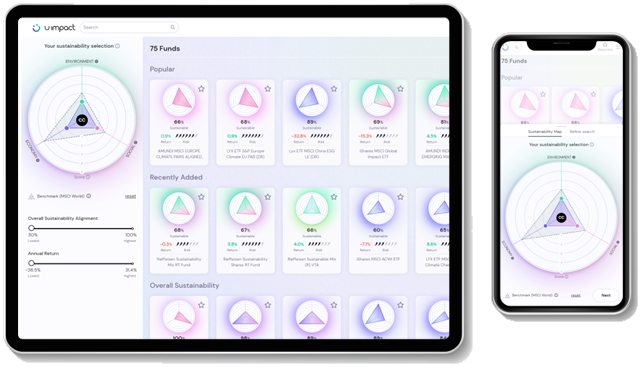

We created an intuitive user interface tailored to retail investors. Now they can invest sustainably as easily as shopping online.

Differentiate yourself

Differentiate yourself in the market with a leading edge interactive and intuitive frontend for mobile and PC.

Gamification

Gamification of fund exploration to optimise investor engagement.

Easy integration

Easy integration to your existing portals and processes.

U Insight

Proprietary insights on investor behaviour for long term retention and continuous engagement.

Investor profiling

Investor profiling using the “U Impact investor framework” and three dimensions (risk, return, responsibility).

Leverage behavioural science

Application of behavioural nudges to increase investor confidence and trust.

Groundbreaking insights

Get access to Proprietary insights and stay ahead of the competition.

Awards

How can you get started?

Our U Impact Pathfinder programme is designed to help you link technology decisions to your product strategy.

Our team has delivered strategy workshops for over a decade for some of the world’s leading organisations.

- Pathfinder

- Executive education

Pathfinder

Product & service roadmapping

for sustainable finance

Our strategic product and service roadmapping for sustainable finance is designed to provide you with a roadmap for introducing new products and services targeted directly to your needs.

Digitalisation

Streamline your sustainability data system

We address your digitalisation efforts, optimising and simplifying your sustainability data operations. Our expertise helps you harness ESG (Environmental, Social, and Governance) data effectively, enabling you to leverage it for informed decision-making and enhanced sustainability performance.

Executive education

Executive education

in sustainable finance

Our executive education program in sustainable investment is tailored for financial institutions, serving as a foundational step in adopting sustainable product solutions.

This comprehensive training equips professionals with the essential knowledge and tools to establish a solid framework for implementing sustainable financial products.

We offer short trainings lasting 1-2 days, as well as more complex programmes on request.

Behavioural finance

Finance should be people-centric.

With our U Impact Behavioural Analytics, we help you deliver the investment products that end-investors want. More capital is mobilised towards reaching Sustainable Development Goals (SDG).

How do we leverage behavioural science?

Analytics

Behavioural analytics in sustainable finance leverages data on investor behaviour to promote environmentally and socially responsible investments. We help you identify trends, combat greenwashing, and align financial products with sustainability goals, fostering a more responsible and sustainable financial ecosystem.

Nudges

We use behavioural nudging to empower investors to make concious sustainable investment decisions. We have developed a nudge catalogue to boost finance and sustainability knowledge, and subsequently increase investor conversion, continuous engagement, and long-term retention.

Content hub

Blog

Our blog posts on sustainable finance and behavioural analytics

Boost your sustainable investment offerings now

Discuss your needs with the U Impact team. We will help you boost your sustainable investment market.